1. There will only ever be 21 million bitcoins created. *woah*

Context time! There are over 46 million millionaires in the United States (according to Google, which is better than according to Facebook but worse than according to the one news outlet you trust because the ~other~ guys are so biased).

You do the math (or pull out your phone and type it in because mental math is soooooo 1983). Ok, ok, I’ll do the math. That means there are not even enough Bitcoins for those stuffy millionaires to each have one. Moral of the story: 21 million Bitcoins is really not that many Bitcoins.

More math! Let’s assume that Bitcoin becomes popular enough that everybody who uses Uber decides to throw some money into Bitcoin. People who Uber seem like the kind of hip, in the know people who would be interested in digital money.

Guess how many people use Uber? The internet says 78 million people. 78 people use a car sharing service that was started less than a year ago and has been surrounded by controversy (shoutout to Lyft… more people should use Lyft).

That means each Uber user would only get (quick mental math) less than a third of a Bitcoin…

Bitcoin. Is. Scarce.

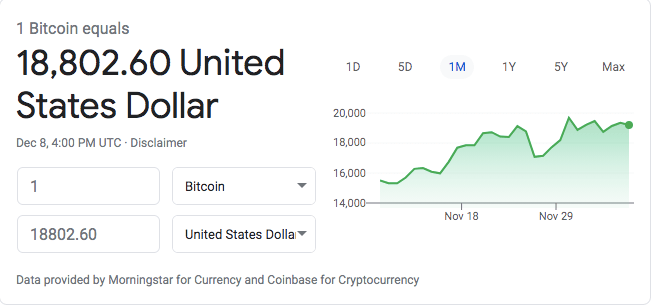

Get your ticket before they run out. Right now you can buy a Bitcoin for 18,000 dollars. That’s with only 25 million owners (type in “how many people own bitcoin?” on Google, don’t trust my silly internet words).

What happens when every Uber user decides to use their hip, in the know-ness to buy a coin? That almost triples the demand! I may not be the smartest cookie in the Tiff’s Treats box, but I did get an A- in Econ 101.

When demand increases, price increases, until supply rises to match demand. (Basic stuff. Look up Supply-Demand curves on Youtube for a refresher if this is giving you Freshman year PTSD.)

If the supply is capped at 21 million… what will make that supply curve move? The price!!! As the demand for Bitcoin rises, the price will keep pushing higher and higher and higher because supply cannot be increased through production.

The only way to convince someone to sell their Bitcoin is to bid higher and higher prices, because there will only ever be a certain amount made.

2. Bitcoin is volatile.

Crazy volatile. Like oh my gosh there is the possibility that I lose all of my money volatile. The price jumps around like a second grader forced into a double dutch jump roping competition in gym class on a particularly rude Tuesday morning. The price can fall unexpectedly, then jump right back up with exuberant resilience, and then find a groove until the next time it gets tripped up (shoutout to Mt. Gox for being a particularly terrible double dutch partner).

This is to be expected. Bitcoin is ten years old. TEN. Guess how old gold is (it’s around 200 million years old according to a sketchy website I found using Bing because sometimes you need to use Bing to remind yourself that grass isn’t always greener on the other side). Bitcoin is a child compared to Gold or money or any other ~money thing~ you are currently thinking about like “ohhh but Bitcoin is so volatile compared to this thing I think is so cool” (cough stock market people).

Here’s how I think of Bitcoin. It is the illegitimate child of the internet and money.

The internet, as we know the internet, has been around since the mid 90s. The internet revolutionized the way we have communicate (email), shop (Amazon), entertain (streaming/Netflix), work (Zoom), and interact (aka we stare at our phones the whole time doing our best to pretend the real world doesn’t exist).

Money has been around since, ummm, forever. It’s part of life. We use it every day and probably don’t even think about what money actually is. Like seriously, why do ten pieces of paper stamped with George Washingtons weird haircut let me purchase ten tacos from Taco Bell? It’s literally a green piece of paper with a dead dude on it.

Well, it’s because (time for Econ 101) we trust that ten dollars is ten dollars is ten dollars. It’s ingrained in society (it’s actually because we trust the United States to keep ten dollars worth ten dollars and that paper bills do a good job as a store of value, medium of exchange, and all those other Econ 101 terms about characteristics of money… but that is just too complicated and hurts the brain).

Bitcoin is the internet version of money! The dollar bill, be it a piece of physical cash or that number sitting in your bank account, Venmo balance, or wherever you keep your money, is a legacy of the old, paper based system of money.

Bitcoin is the cross section between money and technology.

At its core, Bitcoin is exactly that… a piece of code (the bit), housed on the internet, that can be used as a medium of exchange, unit of account, and a store of value (the coin).

The fundamental concept of Bitcoin is easy to understand. It’s a digital form of value. A network of money. The internet of exchange.

The way we use the dollar is outdated. It’s Blockbuster and Bitcoin is Netflix. The Dollar is the U.S Postal Service, Bitcoin is e-mail. The faces of George and Ben and Andrew and all of those dead old fellas found on those green pieces of paper you so love are going to be no match for the digital wave of money that Bitcoin has pioneered.

But…

It’s going to take a long time for that money to find its value. We are living in the VERY beginning of Bitcoin’s existence.

Thought experiment (not based in historical accuracy but also not not based on historical accuracy): what do you think happened when Gold was first introduced as a currency? The first piece of gold was probably bought for like two shells. And then the next week as the utility of gold as money was found to be pretty freaking good, I bet the price of gold skyrocketed to like five shells and a lamb. Or something like that. This is what we call price discovery.

Volatility is to be expected during the phase of price discovery. It should make you excited. There is opportunity here to 5x your shells and lambs. There is also the possibility of losing your shells and lambs (so maybe only invest an amount of shells and lambs that you can lose without going hungry in your hut until you understand Bitcoin enough to sell your hut to buy Bitcoin).

So buckle up. Download some apps to watch the price. Buy the dips and hold the highs.

3. The technology behind Bitcoin is called Blockchain and you should remember that name.

Blockchain is what makes Bitcoin so cool, it’s also what makes Bitcoin so gosh darn confusing. That’s because it’s technical. It uses words like nodes and hash rate and mining and decentralization. Ew.

Here is what you need to know about Blockchain. Blockchain is the way Bitcoin holds your money/value. Blockchain holds together Bitcoin like the internet holds together Facebook/Amazon/Apple/Google/etc. Without the internet bringing information and power from a million different places, those services wouldn’t exist. Same with Bitcoin. Bitcoin would not exist without the Blockchain constantly holding it together.

Sooo, the question is: what is Blockchain?

In broad strokes, the Blockchain is THE journal maintained by hundreds and thousands of computers across the world working together to record each and every Bitcoin transaction.

I hope you read that sentence and thought to yourself: “self, doesn’t that just sound like how the internet works? Also, isn’t that how normal banks do their banking things?”

The answer is yes.

Here is where I will go full info-mercial on you. Queue the “but wait… there’s more” and roll out the boat that I’m going to saw in half and then glue back together using flex seal (if this allusion is lost on you… click this link https://www.youtube.com/watch?v=httSHnNXN10).

The Bitcoin blockchain is ~special~ because nobody is in charge of it! Gasp. Seriously. Nobody is in charge of your money. The blockchain (which is basically a bunch of badass code that has proven sturdy over its’ ten year life span) is in charge of your money.

Bitcoin is decentralized. That is a big word that basically means that instead of trusting say Wells Fargo to hold your money, you are trusting thousands and thousands of computers to run a constant audit of who owns which bitcoins. It’s freaking magical.

Now the question becomes whether you would rather have Kurt from Wells Fargo (Jake from State Farms cousin) handling your money or a nameless set of thousands of computers across the world. Both are weird when you think about it. Both involve a lot of trust.

I mean, I am sure that Kurt is a great dude… but Wells Fargo? How can we be sure they are making correct decision s with our money or how can we be sure that they actually have our money for withdrawal when we go ask for it? When you really sit down to think about it, it is kinda of scary.

That is why I think the blockchain is so cool. It takes the qualitative human characteristic of trust and turns it into a few lines of code. Instead of relying on Kurt from Wells Fargo, you can look at this open ledger of value and the computers on the network (and lets be honest…. Computers are much better at math than us silly homosapiens) to make sure your money safe and in the right place.

Don’t let people scare you away with a scary word like Blockchain. It’s simple. It is a new way to store data, in the case of Bitcoin, to store value. It is an open journal of transactions showing who owns what bitcoins.

4. To understand Blockchain… you have to get a little technical.

Dear non computer people,

Please hang in there. I am going to try and make this painless. Or not that painful. I am going to try and make this the nasal spray flu shot compared to the sharp pointy needle flu shot. It’s still going to suck, but it’s not going to suck quite as much (hopefully!).

To understand Blockchain, you have to get a little technical… but you can also just start asking questions.

Here is a question you probably have: Why are there only 21 million bitcoins and how are they created (remember, from number 1!!!!)?

Here is another question you have probably asked yourself by now: why is it called blockchain? This seems neither blocky nor chainy. What do these chained blocks have to do with these vague journal things. What the heck.

Here is the third question you most definitely have bouncing around that brain of yours: how do we know that those transactions are correct in those silly weird journal things? Just because a computer says it’s so doesn’t mean it’s so. Just type in the internet “best movie of the last twenty years.” The internet and computers are ridiculous sometimes. Mad Max Fury Road?? Are you kidding me? If the internet can be so wrong about movies… then how can we trust it with something as important as our hard earned green dead white person printed face crumpled paper things we call money.

Welcome to the dark side of blockchain. The nitty gritty. The settings of your iPhone. The input button on your living room remote. A dark and scary place.

The blockchain of bitcoin (the decentralized transaction thingy that is super cool) is bounded by three main rules.

First rule: there will only ever be twenty one million Bitcoins ever made. It’s a super cool idea. A hard capped asset. Woot woot.

So, how are they made? Well, Bitcoin, like gold, is mined. Mined!!! Except instead of having a bunch of fellow human beings doing manual labor to find chunks of cool looking metal, Bitcoins are mined in a computer race.

It’s kind of complicated, how this race works. Here is the main idea: mining is a raffle, using computer power to buy tickets. The more computer power (aka electricity and specialized equipment with cool names like Asics) the better the chance of winning the raffle.

Computers race to purchase their raffle tickets as fast as possible. These tickets are really hard math problems. Like really, really hard. Hard enough that the only way for the computers to guess the answers to the problem is guessing and checking and guessing and checking and guessing and checking…

The race takes roughly ten minutes to complete (because the code says so). One lucky computer, the winner of the raffle, is rewarded with Bitcoin!! This is how Bitcoin is made. It is a reward for winning a weird math raffle race. Gosh, Bitcoin is nerdy.

When Bitcoin was first invented, there were 50 Bitcoins awarded every 10 minutes.

Every 4 years, the reward gets cut in half (why… because Code!!). We call those days Halvenings because we are weird people. Right now, a miner is awarded with 6.25 Bitcoin per 10 minutes.

Here is where the question of “why the heck are there only 21 million bitcoin” merges with the question of “I still have no idea what blockchain is can you please just get to the dang point?”

The blockchain, as I talked about above, is a decentralized journal of transactions that nobody is in charge of (but actually everyone is in charge of… it’s complicated like Ross and Rachel on a break complicated). I mentioned that it is constantly under surveillance.

I sort of fibbed. The blockchain, the place that stores all of the transaction data, is updated every ten minutes… coinciding with… dot dot dot … a new set of rewards for a miner!!

The miner who won the raffle has a second duty. The winning miner, that cool cat, sends out their version of the public ledger with all of the new Bitcoin transactions that happened in the last ten minutes along with their reward.

If these transactions are accepted by the community (aka a bunch of computers spread across the world, trained in the art of the audit), then that BLOCK of transactions is accepted and the Bitcoins are sent criss crossing the world (for a small fee that goes to the winning miner… it is really fun to be the winning miner). These BLOCKS are put together every ten minutes, creating a CHAIN of transactions that can be tracked from the beginning of Bitcoin’s life.

Woah this section is getting long. We’re almost done. Sort of. Kinda. Maybe. I don’t know.

Enter the matrix. The dream within a dream. Within a dream. Cue the spinning top (if you do not get this reference… ok boomer).

What does 21 million coins, math raffle tickets, and a blockchain being audited every ten minutes have in common?

Absolutely nothing! Lol jk.

It has to do with trust! The hardest part about this whole Bitcoin thing is trust. Bitcoin is basically just a few lines of code (and code is just a bunch of rules for computers to follow).

The moral of the story is that you have to trust the code. You have to trust the rules of the system. There will be 21 million bitcoins and only 21 million bitcoins. The blockchain is decentralized and can be audited every ten minutes. The transactions on the blockchain are correct because a bunch of computers came together and decided they are correct.

Is that crazy? Yes. Is it crazier than using your computer to send mail or a robot to automatically add something to your grocery list? Maybe, maybe not.

Blockchain is complicated. I only went into the barest of details. I didn’t use weird terms like hash rate or proof of work consensus or double spending or Byzantine general or sha 256 or timestamp, or anything like that. That stuff is good to know, but not NECESSARY in understanding Bitcoin.

5. The guy who invented is named Satoshi Nakamoto.

P.S. Congratulations for making it through Blockchain. That stuff can get ~tiresome~

P.P.S. It’s about to get weirder.

Nobody knows who invented Bitcoin. We have a name. Satoshi Nakamoto. We have a bunch of emails, a white paper (which you should DEFINITELY read), and a lot of blog posts with titles like “Satoshi Nakamoto Lived in London While Working on Bitcoin. Here’s How We Know.” Articles like that crack me up because like… do you KNOW or are you pretty sure you KNOW. That is a pretty big difference. Silly gooses.

Anyways. Back to my dude Satoshi.

Here is what we know for sure about Satoshi: he/she/they/them/ wrote the white paper and registered Bitcoin.org in August of 2008. In January of 2009 the code went live and the first ever block of bitcoins were mined by Satoshi (this is called the Genesis Block… what a freaking name). In this genesis block, Satoshi left a message (encoded, obviously). Don’t worry about how he/she/them/they encoded a message in a block on the blockchain. Just… accept it like you accept those terms and conditions on your Netflix account every month when your subscription automatically renews… with blind faith.

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This is a reference to the cover story of The Times on Jan. 3, 2009. Nobody knows for SURE why Mr. Nakamoto decided to include this little tidbit in the genesis block of the first secure form of digital money ever created.

I read it as the most aggressive-aggressive subtweet of all time.

Bitcoin was born into the post 2008 hellfire and brimstone economy, rife with debt and bloated with government funded bailouts. At least, that is what I gathered from Margot Robbie in “The Big Short” (it’s a movie about how f’d up the economy got because of greedy banks and bad loans and a crazy housing market). I was 10 during the 2008 crash.

The Genesis Block is Satoshi’s checkmate, his ultimate flex. By creating this little piece of digital gold, Satoshi created an escape route from the current monetary system.

After the Genesis Block, Satoshi kind of faded away. His responses to emails dwindled and his involvement with the coding dissipated. Nobody knows who he/she/they/them are. Lot’s of people have tried to figure out who it is behind the white paper.

I honestly don’t care. Like, do I know who invented the internet? No (I mean I could look it up… but, ummmm, who cares?) Do I know who came up with the idea of money? No. So why should I care about who invented internet money?

Great question.

I’ll let you think on that.

Next week we’ll tackle Part 2 of the Manifesto.

- Psyeduenoymos vs Anonymous

- Sketchyness versus sketchyness

- If it was easy to buy it would already be cool

- A little history and a little future

- The best way to learn