Bitcoin’s Daily Yin and Yang:

Yin: Microstrategy, those beautiful cyber-hornets, just announced a new ploy to raise $400 million in bonds to purchase more Bitcoin. Saylor and Co have already bought 40,000+ Bitcoins since the company first announced an interest in the internet of money back in early August. (https://www.bloomberg.com/news/articles/2020-12-07/microstrategy-to-raise-400-million-to-buy-even-more-bitcoin)

Yang: G7 Finance Ministers stress the need to regulate digital currencies, writes a news release from Coindesk earlier this morning. What does that mean? The G7 stands for Group of Seven, an organization made up of the largest advanced economies in the world: Canada, France, Germany, Italy, Japan, the UK, and the United States. The group regards itself as a community of values and meets to exchange ideas on possible solutions to global economic crises. Yesterday was their 12th meeting. The meeting was about REGULATION not extermination. Crypto holders should be excited that their silly internet money is being discussed by the foremost financial analysts in the world. Crypto holders should also be a little worried because governments are probably going to come out with some wack regulations at first. (https://home.treasury.gov/news/press-releases/sm1203) + (https://www.coindesk.com/g7-officials-stress-need-to-regulate-digital-currencies-us-treasury)

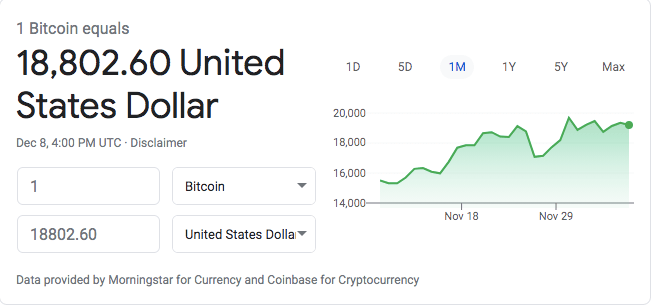

The result of typing “What is the price of bitcoin?” into Google:

What is Ethereum?

If Bitcoin is digital gold, Ethereum is digital plumbing. What??? Sorry, bad metaphor.

The current financial system in the U.S. is woefully outdated. Banks never overhauled their accounting systems to take into account the internet revolution. Instead, they used the internet as a crutch, twisting and copying+pasting their old methods of accounting into digital form. It’s messy and inefficient. The current system is a Rube Goldberg Machine, where you tip a domino over that hits a golf ball that rolls across a wooden slide that somehow makes a bowling ball lever down a staircase that hits some bowling pins that end up pouring cereal into your bowl. It’s crazy confusing.

How long does it take your bank to settle a credit card transaction? Probably 2-3 days. Why? Because the bank has to settle the payment between your credit card company, the place where you made the purchase, the place where you made the purchase’s bank, and your bank. Gross, right.

Ethereum is a protocol, like the internet is a protocol, that allows money to be moved almost instantaneously and very efficiently through something called a “smart contract.” A smart contract is a deceivingly simple concept. It is basically an automated contract that is transcribed to the blockchain (big words that mean written down in a public journal) once the terms of agreement are met by both sides.

In the case of a credit card purchase, the smart contract would look at your bank account and see $4.32, which is enough to purchase a large fry from McDonalds. At the same time, the contract would look for a confirmation that McDonalds does, in fact, have fries and is willing to serve you at the moment. If both sides confirm, the contract is pushed through to the blockchain and automatically transacts.

Ethereum takes out the Rube Goldberg Machine in Finance. If you want a bowl of cereal, you pour the bowl of cereal, instead of having to go through all of that mumbo jumbo with the dominos and the bowling balls.

Pretty cool, right?

That’s all I have for the day

-Kram